Term Insurance

Term Insurance is Life Insurance you can purchase that covers you for a limited, specific amount of time — five, ten, or twenty years, for example — at a fixed rate of payment. Should the insured die during that term, the death benefit is paid to their beneficiary. Term Insurance is often the least expensive way to purchase a substantial death benefit in a cost-effective manner.

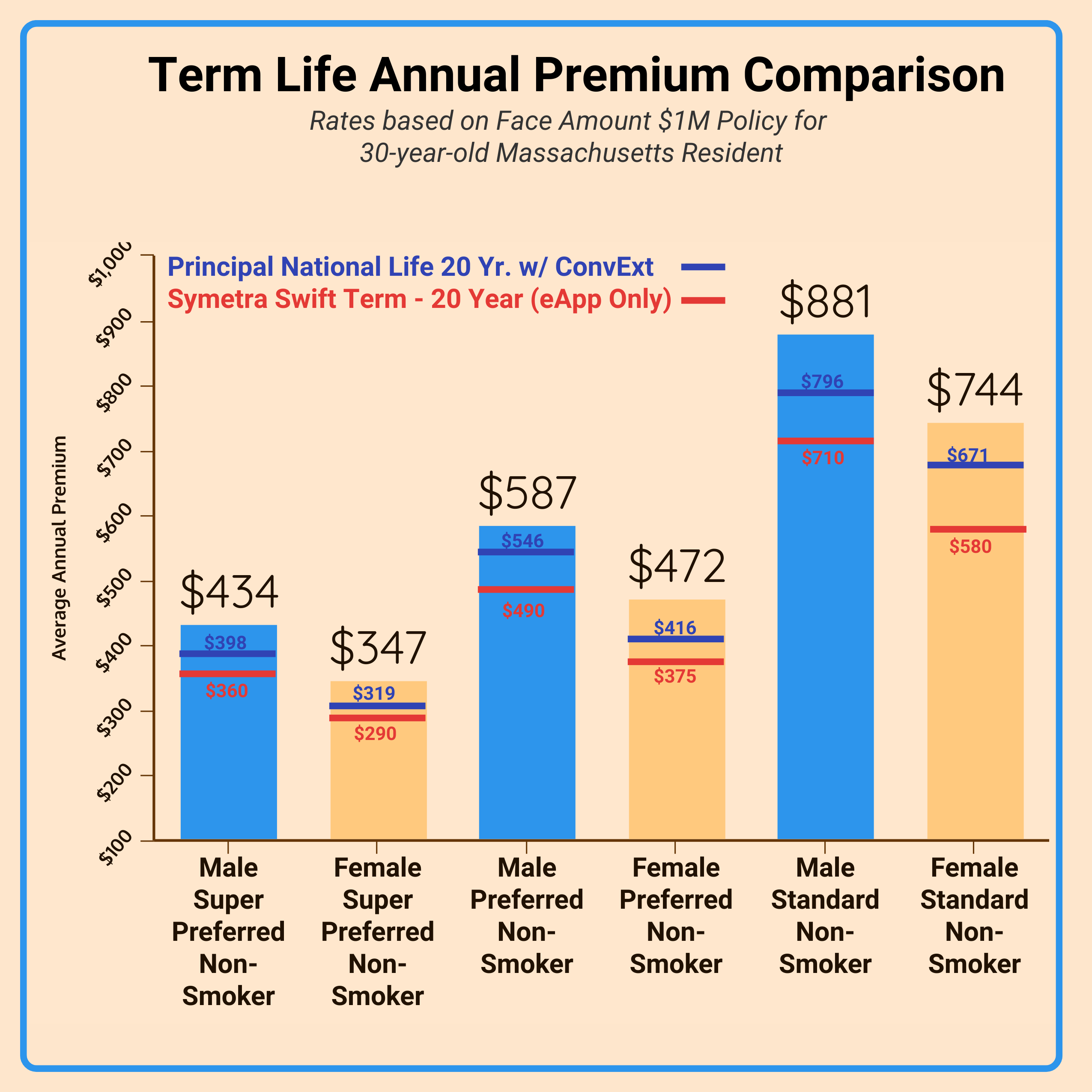

Costs vary depending on several parameters, like age, health, and other relevant demographic information. They also vary among life insurance companies, as illustrated in the table below.

A Comprehensive Approach to term Life Insurance

At Capital Formation Group, we believe that life insurance is most effective when it’s part of a comprehensive, planning-based strategy—one that supports your broader financial and estate goals. Fully-underwritten Term and Permanent life insurance solutions remain the cornerstone of our approach, offering the flexibility, longevity, and customization needed to align with each client’s long-term plan.

However, we recognize that some clients may benefit from a simpler, faster solution. Through our partnership with Valmark, we now have access to Ladder Life Insurance, a 100% digital, instant-issue term policy designed for those who need straightforward protection without the time or requirements of medical underwriting.

Ladder Life Insurance Highlights

-

No medical exams or traditional underwriting for policies up to $3 million

-

Instant decision and online application process

-

Adjustable coverage—clients can increase or decrease coverage amounts directly online

-

Available to clients ages 20–60 seeking affordable term-only protection

-

Policies issued by Amica and Allianz

Ladder may be a practical option for tech-savvy individuals, new parents, or recent homebuyers who need coverage quickly and at a lower cost. While it is not convertible and does not provide the long-term planning benefits of traditional term or permanent insurance, it offers a convenient way to secure immediate protection when speed and simplicity matter most.

For more information about Ladder Life Insurance or to explore which strategy best fits your goals, please contact us!

To purchase Term Insurance from John Williams or Mikhail Veselov through Ladder Life Insurance, scroll down and click either of the buttons below their pictures.

Disclosure: All Term Insurance purchases made through clicking these buttons are made through ladderlife.com, and Ladder Life is not affiliated with Valmark Securities, Inc. or Valmark Advisers, Inc.

Disclosure: This example comparison is hypothetical and for illustrative purposes only.

Below are just a few of the term insurance-related problems we’ve been able to solve for clients. Click the silver bar for each problem to learn more about how we can solve them.

Term Insurance Solutions

Determining Adequate Coverage Amount

High net worth individuals and families often struggle to determine the right amount of coverage needed to protect their family’s financial future. We can perform a comprehensive needs analysis to verify that the Term Life Insurance coverage adequately meets your dependents’ needs in case of your untimely death.

Balancing Cost and Coverage Duration

Finding a balance between affordable premiums and the desired coverage duration can be challenging. We can can help you choose a term length that aligns with your financial obligations and goals with premiums that remain manageable within your overall budget.

Integrating with Long-Term Financial Goals

It can be difficult to make Term Life Insurance fit seamlessly into long-term financial plans and goals. We can provide guidance on how Term Life Insurance complements other financial strategies, such as retirement planning and estate planning, to create a cohesive financial plan.

Conversion Options and Flexibility

Understanding the conversion options and flexibility of Term Life Insurance policies can be confusing. We can explain these features and advise on when and how to convert term policies to permanent insurance, ensuring that you maintain coverage as your needs evolve.

Coverage Gaps and Renewal Concerns

Prospective clients often worry about coverage gaps or the high cost of renewing Term Insurance as they age. We can review existing policies, recommend strategies to avoid coverage lapses, and help explore alternatives, such as laddering policies, to maintain adequate protection over time.

Disclosure: No payments were made to the above listing of clients who offered their opinions/testimonials regarding our services. These client experiences may not be representative of all clients.

2 Newton Executive Park

2227 Washington Street, Suite 303

Newton, MA 02462

Phone: 781.237.0123

Fax: 781.237.1696

E-mail: info@capformgroup.com